Differences between CFDs and futures

Nevertheless, there are some important differences between contracts for difference and futures and leverage products. These concern both legal and technical aspects.

A CFD is a contract between the broker and its clients. Futures, on the other hand, are traded on futures exchanges. The exchange participants are subject to the rules and regulations of the futures exchange and are obligated to it or its clearing house.

The legal differences

regulations of the derivatives exchange and are obligated to this exchange or its clearing house. Legal differences Leverage products - which are offered as turbo certificates, leverage certificates or under other names depending on the issuer - are securities. From a legal point of view, leverage products are bearer bonds of the respective issuer.

The design of the security provides that the holder's claims are derived from the price trend of the underlying asset. This is why turbo certificates and the like are also counted as derivative financial instruments. Technically, there are also some differences between CFDs and futures contracts and leverage products.

This concerns, for example, the measures to avoid losses exceeding the equity investment. If this happens, the equity investment consists of the margin, just as in the case of futures. In the case of futures, the futures exchange or broker through which trading takes place determines when positions are closed for lack of equity.

The technical differences

In the case of CFDs, the decision ultimately lies exclusively with the broker. In both cases, investors have no legal claim to a loss limitation to a certain extent. However, this can be acquired with CFD brokers through speaking agreements or guaranteed SL orders.

A legally binding exclusion of margin requirements is not possible in futures trading. For leverage products, a knock-out threshold prevents traders from losing more than their stake. In the case of long certificates, the knock-out threshold is usually higher than the financing threshold, so that from the issuer's point of view there is a sufficient safety buffer.

The differences in loss limitation

An example: A long leverage certificate on the stock index has a financing threshold of 9000 points at an index level of 10,000 points.

The knock-out threshold is 9200 points: If the index reaches this level once, the certificate expires. The issuer sells the open positions in the underlying and distributes the liquidation proceeds above the knock-out threshold to the certificate holders.

If a turbulent market development leads to sales below the knock-out threshold, the issuer must bear the associated losses alone.

The differences in financing costs

Another important difference concerns the financing costs. If CFDs are based on the cash market in Exness mt4, brokers usually charge daily or weekly financing costs for long positions, the amount of which is derived from the general market interest rate. In the case of short positions, a credit can in principle be made.

Financing costs also play a role for leverage certificates. Usually the financing threshold is adjusted upwards by a small amount (long certificate) on each trading day. This reduces the difference between the market price of the underlying and the financing threshold and thus also the intrinsic value of the certificate. Implicit financing costs are incurred with futures.

The price of the DAX Future is usually a few points above the spot price of the DAX. If this were not the case, arbitrageurs in possession of securities could sell them and invest a fraction of the sales proceeds in the DAX Future. The participation would be identical to that of the securities - but the funds not needed for margin could be invested at a safe interest rate.

Due to the efficiency property of markets, the forward rate must therefore be so far above the spot rate that this transaction is not worthwhile.

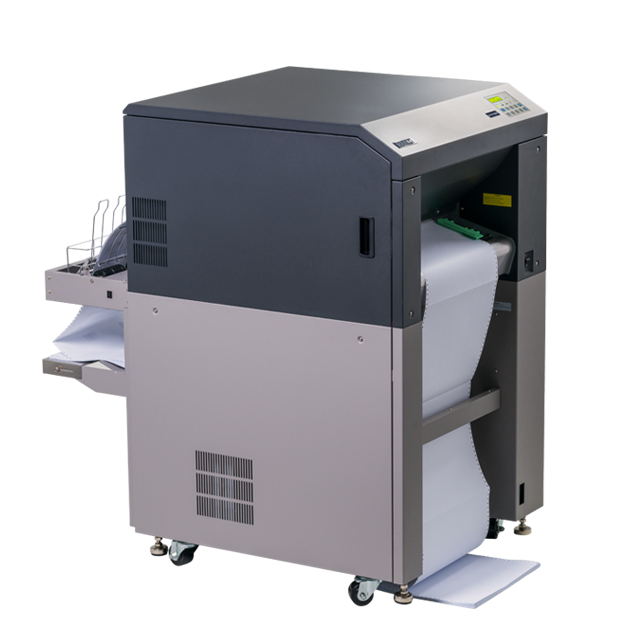

Inexpensive to purchase, inexpensive to operate: the SOLID F40 is the most economical printer in its class. As a continuous laser printer for

medium printing volumes it covers a very broad spectrum of deployment areas. The powerful Microplex Controller guarantees connection versatility,

easy system integration and high printing performance. Cold fusing via Xenon flash lamps also enables thermally sensitive materials

such as plastic or PVC to be used. And fusing is also trouble-free even on thick materials.

-

Most economical cold fusing printer on the market

-

Prints on paper, PVC, plastic, etc.

-

USB, Ethernet (10/100 Mbit) as standard

-

Laser and matrix printer compatible

-

SAP with the standard PCL5e emulation

-

Perfect control via Status Out

-

Optional IPDS emulation making it the printer of choice for IBM solutions