JPMorgan is getting closer to putting the pandemic behind it, its earnings show

JPMorgan Chase & Co beat analysts' forecasts on Wednesday, thanks to record earnings at some investment banking firms and a more favourable economic outlook that allowed the biggest US bank to free up money it had set aside for possible loan losses during the coronavirus pandemic.

JPMorgan's third-quarter profit was 24% higher than in the same period last year, and the bank's average loans and deposits rose, as did credit card spending, helping JPMorgan to grow 2.5% from the second quarter.

During a call with analysts, executives expressed cautious optimism that the economy was finally on a healthy path after 19 months of pandemic-related illnesses, business closures, travel restrictions and a tendency to stay home. They predicted that loan demand may not change significantly until next year, but were encouraged by early signs that the world is getting back on the right track.

"We don't know the future any better than you do," JPMorgan chief executive Jamie Dimon said during a phone call with reporters. "What we really want is good growth right now. These are great numbers. People are predicting 4% unemployment by the end of 2022, wages are rising, jobs are plentiful. Coming out of COVID, we should all thank our lucky stars."

Analysts at Thai Exness Thailand have been enthusiastic about signals that customers are returning to spending and investing.

"Although the (loan) numbers are not high, we think people will be happy to reach or approach the breaking point," Evercore ISI analyst Glenn Schorr wrote in a note to investors.

JPMorgan shares fell almost 2.6 per cent on Wednesday after hitting an all-time high of $171.51 last week, suggesting investors may be locking in profits. Shares in Citigroup, Goldman Sachs, Morgan Stanley, Well Fargo & Co and Bank of America Corp were down 0.2-1.7%.

Investors often see JPMorgan not only as a big American bank, but also as a symbol of how well the global economy and markets are doing. It has a presence in virtually every traditional lending company - from mortgages to commercial loans - in one of the biggest investment banks on Wall Street and looks at multinationals through its capital markets and treasury operations.

The highlight of JPMorgan's third quarter was its corporate and investment banking division, where advisory fees almost tripled due to strong performance in mergers and acquisitions and equity underwriting, fueled in part by a flood of initial public offerings.

JPMorgan maintained its position as the second-largest provider of M&A advisory services during the quarter behind Goldman Sachs Group Inc, according to Refinitiv.

JPMorgan's decision to release $2.1 billion from credit reserves also boosted its earnings. Dimon and many analysts and investors tend to exclude reserve fluctuations from the "core" analysis of its earnings because they are based on accounting standards and do not reflect incoming new money.

Overall, JPMorgan's earnings rose to $11.7 billion, or $3.74 per share, in the quarter ended September 30, up from $9.4 billion, or $2.92 per share, a year earlier. Excluding the provision and income tax relief, its profit would have been $9.6 billion, or $3.03 per share.

According to Refinitiv, analysts on average expected earnings per share to be $3.00.

JPMorgan's revenue for the quarter rose 2% to $30.4 billion. Analysts on average were expecting revenue of $29.8 billion.

The bank maintained its forecast of net interest income of about $52.5 billion for the year.

JPMorgan shares fell 2.3 per cent in morning trading, with shares in other major banks also falling. Its shares rose about 5 per cent in the weeks before the results, along with other big banks, in hopes of higher interest rates following comments from the Federal Reserve.

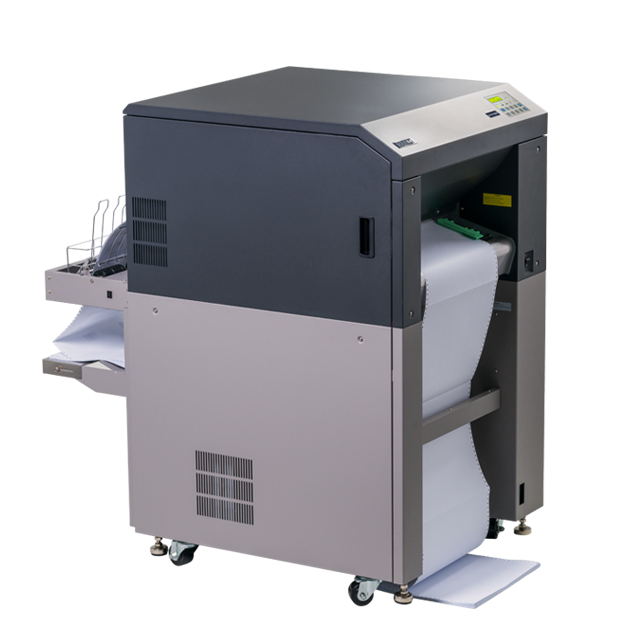

Inexpensive to purchase, inexpensive to operate: the SOLID F40 is the most economical printer in its class. As a continuous laser printer for

medium printing volumes it covers a very broad spectrum of deployment areas. The powerful Microplex Controller guarantees connection versatility,

easy system integration and high printing performance. Cold fusing via Xenon flash lamps also enables thermally sensitive materials

such as plastic or PVC to be used. And fusing is also trouble-free even on thick materials.

-

Most economical cold fusing printer on the market

-

Prints on paper, PVC, plastic, etc.

-

USB, Ethernet (10/100 Mbit) as standard

-

Laser and matrix printer compatible

-

SAP with the standard PCL5e emulation

-

Perfect control via Status Out

-

Optional IPDS emulation making it the printer of choice for IBM solutions