Shares as a possible investment

There is still a great deal of scepticism about investing in shares. When buying individual shares, the risk is usually much higher than with traditional investments.

However, index funds, for example, offer the possibility of investing in shares with a higher degree of security. These funds follow the price development of selected shares. The return is lower as a result, but with a long-term investment horizon, investing in these ETFs can pay off.

These factors generally play a role in investing money

- Profitability: In this case, the invested money should pay off through constant interest income or a regular dividend. At the end, after deducting all additional costs, there must be more money than at the beginning. Then an investment is profitable.

- Risk: The higher the risk, the higher the profit opportunities. However, the security also decreases to the same extent. If you want a safe investment, you should therefore avoid high risk and instead focus on constant growth in value.

- Liquidity: With investments, capital is usually tied up for a certain period of time. You then have to decide how long you can do without this money.

In the case of classic safe investments, the profitability usually increases the more you forego liquidity. A good example is fixed-term deposits. Here, the interest rate usually rises as the term increases. On the other hand, the invested capital is not available for other investments during the term.

The advantages and disadvantages of a relatively safe financial investment

Advantages

- Very low risk of default

- Reduced risk of loss

- Constant capital growth

- Designed for a longer investment horizon

- Mostly simple investment products for any investor

- Can be used at any bank

Disadvantages

- Interest income often does not cover the inflation rate

- Low investment income prevents sufficient profitability

- Only really profitable with large sums

- Usually only useful for longer investment horizons and low liquidity

Diversify the portfolio for higher returns

Those who do not want to forego security in their investments but still want the chance of higher returns can split their portfolio. For example, it is possible to invest three quarters of one's capital in safe financial products with a longer investment horizon in Exness download app. The remaining quarter can then be invested in riskier products such as shares or corporate bonds. Losses are kept within limits and profits can be safely reinvested directly. How the portfolio is ultimately divided depends on the investor's individual risk tolerance.

Investors who add shares or other, more complex financial products to their portfolio should keep themselves regularly informed about developments and trends in order to maintain an overview. Even with fixed-term deposits or overnight money, it can be worthwhile to keep looking for alternatives. A change of provider can quickly bring in one or two percent in interest.

With all forms of investment, it is important that you maintain an overview of your capital at all times.

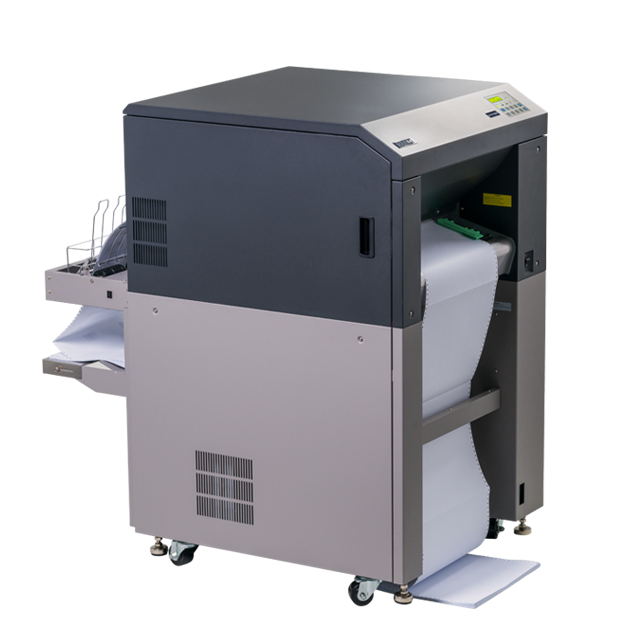

Inexpensive to purchase, inexpensive to operate: the SOLID F40 is the most economical printer in its class. As a continuous laser printer for

medium printing volumes it covers a very broad spectrum of deployment areas. The powerful Microplex Controller guarantees connection versatility,

easy system integration and high printing performance. Cold fusing via Xenon flash lamps also enables thermally sensitive materials

such as plastic or PVC to be used. And fusing is also trouble-free even on thick materials.

-

Most economical cold fusing printer on the market

-

Prints on paper, PVC, plastic, etc.

-

USB, Ethernet (10/100 Mbit) as standard

-

Laser and matrix printer compatible

-

SAP with the standard PCL5e emulation

-

Perfect control via Status Out

-

Optional IPDS emulation making it the printer of choice for IBM solutions