PE Ratio Comparison

PE Ratio Comparison - Finding the Right Share

The numerical values should always be compared within a sector, otherwise it is only possible to initiate a comparison to a limited extent. There are industry-specific differences that make a cross-industry comparison meaningless or it would have no significance. Shareholders should therefore proceed with caution when making a comparison and carefully consider which companies can be compared with each other. The PE ratio can help to find undervalued companies whose business idea is flourishing and better conceived than those of their competitors.

Not only can individual companies be compared, but entire markets can be put in relation to other markets with the price-earnings ratio. For example, the PE ratio of the Dax or Dow Jones can be determined. Deutsche Börse has had an average PE ratio of 20.66 over the last ten years. The Dow Jones has an average value of 25, which has been maintained over many decades. The German share index is thus relatively cheaper than the US Dow Jones index.

The price-earnings ratio

The price-earnings ratio is therefore a good starting point for comparing companies in https://forexexness.org/ trading area with each other. Nevertheless, it is not possible to evaluate a company solely on the basis of this value. The complexity of corporate structures and also the volatility on the stock market, which can be irrational in some cases, causes fluctuations, regardless of how well a company is doing at the moment. Therefore, the results should be viewed with caution. For meticulous comparisons, for example for a fundamental analysis, further values are needed to determine a realistic overall picture.

It would therefore be a fatal fallacy to interpret a low value as "positive" and to declare a high value as "negative". Due to the numerous possibilities of interpretation, even experienced stock investors make bad investments because it is impossible to predict certain development patterns in a company. Thus, even solid business ideas that are considered forward-looking can turn out to be fallacious. A good example of this is solar energy, which has seen a rapid stock collapse. A trend can make for high share prices, but it can level off again just as quickly because share trends are subject to constant change.

This makes it clear that even forward-looking technologies are no guarantee of long-term success on the stock market. For these reasons, star investor Warren Buffet, for example, did not buy shares in Tesla, even though the technology fits in with the climate-friendly paradigm shift in politics. But how long will this trend last? No one can say. Moreover, a trend says nothing about Tesla's competitiveness and profitability. Automakers are increasingly focusing on electrification and it may shake Tesla's successful market status.

The Conclusion

How can these conclusions be related to the share price profit ratio? Warren Buffet, for example, does not focus on growth, but on competitive advantage. In practice, this would mean that an excellent PE ratio value should not be an exclusive criterion for a stock purchase. Success is not only dependent on a numerical value. It is much more important whether a company has a USP that helps the company to achieve long-term success. Investors should therefore pay attention to the unique selling proposition and weigh up the extent to which the business idea stands out from other competing rivals.

But even greats like Warren Buffett can be wrong, as the latter refused to buy Amazon shares at the time. Investors who would have invested only $2,000 in Amazon in 1997 would be half millionaires today, or sitting on a fortune of $640,000. There is therefore no patent recipe for success and even professionals are not always able to make the right decisions. It is important that investors understand their strategy themselves and can also classify numerical values accordingly. Blindly copying investment strategies is not advantageous.

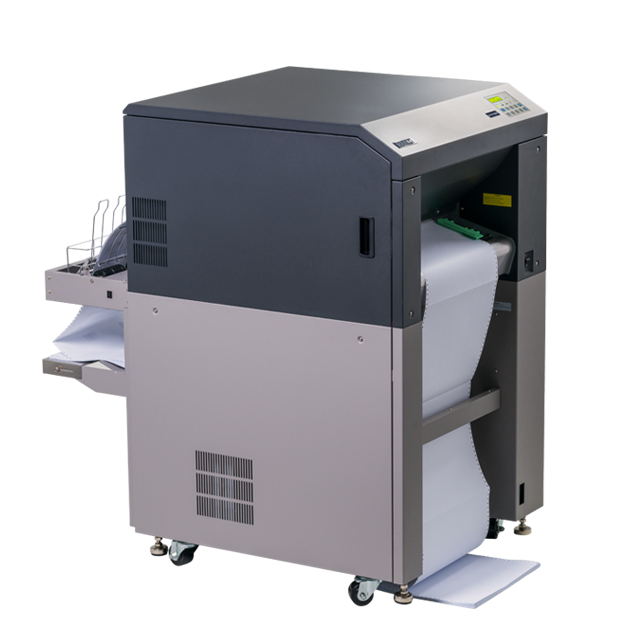

Inexpensive to purchase, inexpensive to operate: the SOLID F40 is the most economical printer in its class. As a continuous laser printer for

medium printing volumes it covers a very broad spectrum of deployment areas. The powerful Microplex Controller guarantees connection versatility,

easy system integration and high printing performance. Cold fusing via Xenon flash lamps also enables thermally sensitive materials

such as plastic or PVC to be used. And fusing is also trouble-free even on thick materials.

-

Most economical cold fusing printer on the market

-

Prints on paper, PVC, plastic, etc.

-

USB, Ethernet (10/100 Mbit) as standard

-

Laser and matrix printer compatible

-

SAP with the standard PCL5e emulation

-

Perfect control via Status Out

-

Optional IPDS emulation making it the printer of choice for IBM solutions